- HOME

- SOLUTIONS

- JEWELRY METAL RECOVERY

- EXTENDED PRODUCER RESPONSIBILITY (EPR)

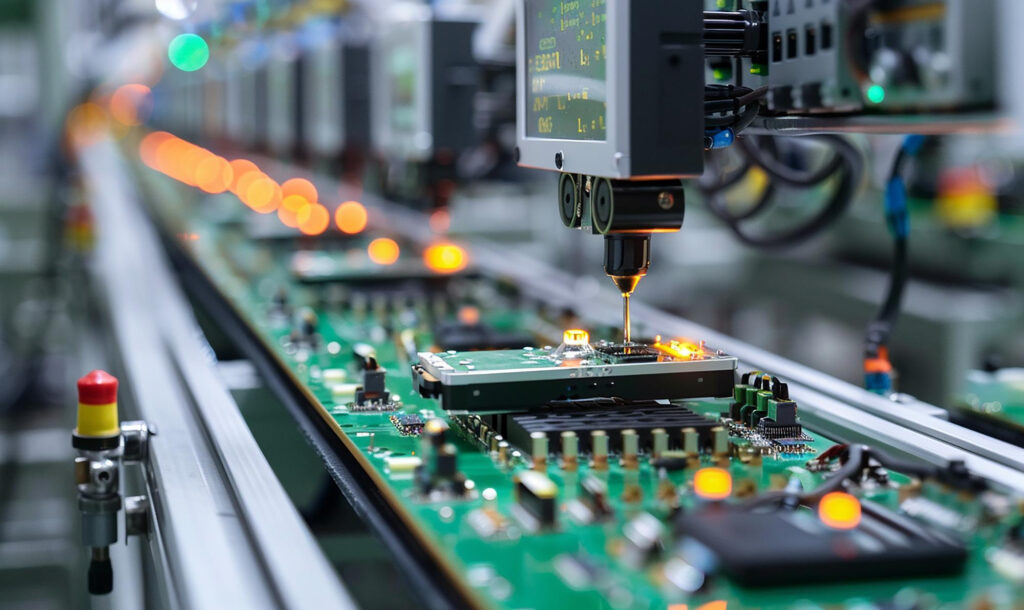

- PRECIOUS METAL REFINING FOR PLATING & ELECTRONICS

- ELECTROWINNING FOR PRECIOUS METAL RECOVERY

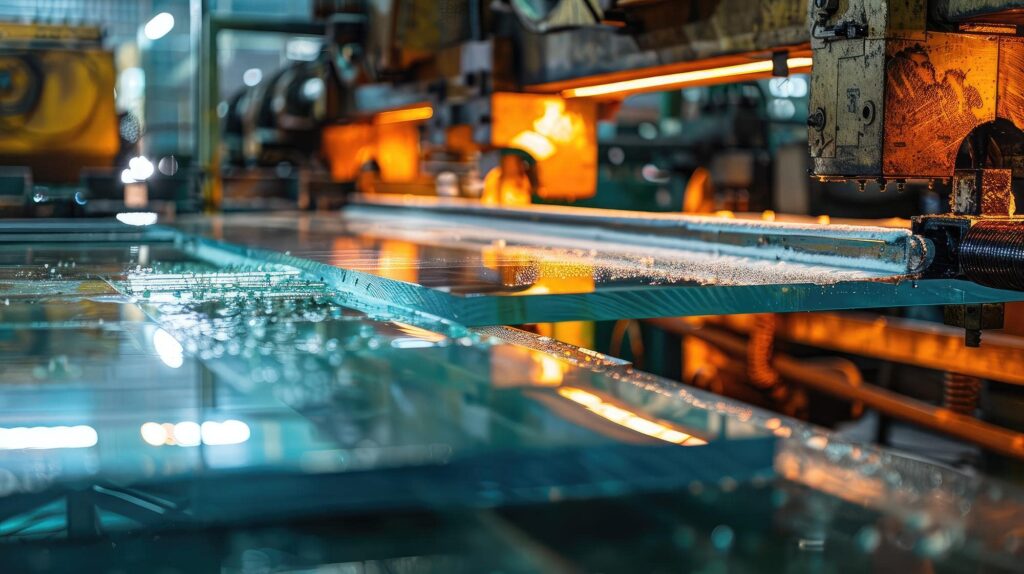

- SPECIALISED RECOVERY & REFINING SOLUTIONS FOR THE GLASS MANUFACTURING INDUSTRY

- PRECIOUS METAL RECOVERY SOLUTIONS FOR THE PHARMACEUTICAL INDUSTRY

- REFURBISHING

- ITAD SOLUTIONS

- SUSTAINABILITY

- CERTIFICATIONS

- ABOUT

- NEWS

- INVESTORS

- BLOG

- HOME

- SOLUTIONS

- JEWELRY METAL RECOVERY

- EXTENDED PRODUCER RESPONSIBILITY (EPR)

- PRECIOUS METAL REFINING FOR PLATING & ELECTRONICS

- ELECTROWINNING FOR PRECIOUS METAL RECOVERY

- SPECIALISED RECOVERY & REFINING SOLUTIONS FOR THE GLASS MANUFACTURING INDUSTRY

- PRECIOUS METAL RECOVERY SOLUTIONS FOR THE PHARMACEUTICAL INDUSTRY

- REFURBISHING

- ITAD SOLUTIONS

- SUSTAINABILITY

- CERTIFICATIONS

- ABOUT

- NEWS

- INVESTORS

- BLOG

- HOME

- SOLUTIONS

- JEWELRY METAL RECOVERY

- EXTENDED PRODUCER RESPONSIBILITY (EPR)

- PRECIOUS METAL REFINING FOR PLATING & ELECTRONICS

- ELECTROWINNING FOR PRECIOUS METAL RECOVERY

- SPECIALISED RECOVERY & REFINING SOLUTIONS FOR THE GLASS MANUFACTURING INDUSTRY

- PRECIOUS METAL RECOVERY SOLUTIONS FOR THE PHARMACEUTICAL INDUSTRY

- REFURBISHING

- ITAD SOLUTIONS

- SUSTAINABILITY

- CERTIFICATIONS

- ABOUT

- NEWS

- INVESTORS

- BLOG